22.3.2010 | 09:10

EKKI ÞARF NEINA "SÉRFRÆÐINGA" FRÁ AGS TIL AÐ SJÁ ÞETTA.........

Skuldasöfnun hins opinbera og það vandamál að rekstur hins opinbera er eins ÓÁBYRGUR og nokkur maður getur hugsað sér er eitt STÆRSTA vandamálið í alþjóðlegu viðskiptaumhverfi í dag. Þeir sem annast rekstur opinberra fyrirtækja og stofnana, í það minnsta hér á landi og örugglega á það sér hliðstæður erlendis, eru flestir gjörsamlega vanhæfir til að gegna því starfi enda hafa flestir fengið störf sín á pólitískum forsendum og sökum tengsla en ekki vegna verðleika. Menn geta sagt sér sjálfir að með Jarðfræðing sem fjármálaráðherra er ekki von á góðu. Margir héldu nú að við hefðum "toppað" vitleysuna með því að hafa Dýralækni sem fjármálaráðherra en það átti eftir að koma í ljós að ekki var Jarðfræðingurinn sem tók við af honum neitt skárri, verri ef eitthvað var. Það virðist vera að það eina sem hægt er að gera í ríkisfjármálunum, sé algjör uppstokkun á rekstri ríkisins og opinberra stofnana og að hætt verði að taka einhverjum "vettlingatökum" á forstöðumönnum/konum stofnana og fyrirtækja sem EKKI virða fjárlög.

|

AGS varar við aukningu skulda hins opinbera |

| Tilkynna um óviðeigandi tengingu við frétt | |

Flokkur: Viðskipti og fjármál | Facebook

« Síðasta færsla | Næsta færsla »

Bloggvinir

-

annabjorghjartardottir

annabjorghjartardottir

-

arnarthorjonsson

arnarthorjonsson

-

skagstrendingur

skagstrendingur

-

formula

formula

-

reykur

reykur

-

flinston

flinston

-

asthildurcesil

asthildurcesil

-

biggilofts

biggilofts

-

bjarnijonsson

bjarnijonsson

-

bjarnimax

bjarnimax

-

westurfari

westurfari

-

bjornaxelsson

bjornaxelsson

-

bokin

bokin

-

dagsol

dagsol

-

einarbb

einarbb

-

einarvill

einarvill

-

einarorneinars

einarorneinars

-

finnur

finnur

-

fritzmar

fritzmar

-

georg

georg

-

gislim3779

gislim3779

-

gudbjornj

gudbjornj

-

gutti

gutti

-

elnino

elnino

-

manix

manix

-

zumann

zumann

-

gmaria

gmaria

-

noldrarinn

noldrarinn

-

tilveran-i-esb

tilveran-i-esb

-

gthg

gthg

-

gunnsithor

gunnsithor

-

gustafskulason

gustafskulason

-

halldorjonsson

halldorjonsson

-

hallurhallsson

hallurhallsson

-

hbj

hbj

-

hallibjarna

hallibjarna

-

heimssyn

heimssyn

-

formannslif

formannslif

-

diva73

diva73

-

helgatho

helgatho

-

helgigunnars

helgigunnars

-

hordurhalldorsson

hordurhalldorsson

-

ingagm

ingagm

-

ingolfursigurdsson

ingolfursigurdsson

-

thjodfylking

thjodfylking

-

astromix

astromix

-

fun

fun

-

jensgud

jensgud

-

ezuz

ezuz

-

joiragnars

joiragnars

-

johannvegas

johannvegas

-

jaj

jaj

-

fiski

fiski

-

jonerr

jonerr

-

bassinn

bassinn

-

jonsnae

jonsnae

-

jonvalurjensson

jonvalurjensson

-

thjodarskutan

thjodarskutan

-

juliusvalsson

juliusvalsson

-

ksh

ksh

-

kolbrunerin

kolbrunerin

-

kristinn-karl

kristinn-karl

-

kristinthormar

kristinthormar

-

stinajohanns

stinajohanns

-

keh

keh

-

kristjan9

kristjan9

-

magnuss

magnuss

-

magnusthor

magnusthor

-

odinnth

odinnth

-

solir

solir

-

olafurjonsson

olafurjonsson

-

os

os

-

pallvil

pallvil

-

ragnar73

ragnar73

-

rosaadalsteinsdottir

rosaadalsteinsdottir

-

hughrif

hughrif

-

fullveldi

fullveldi

-

seinars

seinars

-

nafar

nafar

-

holmarinn

holmarinn

-

sigurdurig

sigurdurig

-

siggiflug

siggiflug

-

siggith

siggith

-

sigurjonth

sigurjonth

-

stormsker

stormsker

-

timannatakn

timannatakn

-

tibsen

tibsen

-

valdimarjohannesson

valdimarjohannesson

-

skolli

skolli

-

valur-arnarson

valur-arnarson

Nýjustu færslur

- HVAÐA RÁÐ ERU TIL AÐ RÁÐHERRAR FARI AÐ LÖGUM OG BÖÐLIST EKKI...

- ÞEGAR "SKESSURNAR" FARA AÐ LEIKA SÉR AÐ ELDINUM - VERÐA ÞÆR A...

- VERÐA ÞÁ "BOLABRÖGÐIN" ÚR SÖGUNNI???????

- LOSUM OKKUR ÚR NATO - SEGJUM OKKUR ÚR SCHENGEN OG SEGUM UPP E...

- OG ERU EINHVERJAR "ALVÖRU" RÁÐSTAFANIR FYRIRHUGAÐAR???????

- HAFA VERIÐ GERÐAR BREYTINGAR Á STJÓRNARSKRÁNNI OG STJÓRNSKIPU...

- ÞAÐ ER NÚ EIGINLEGA LÁGMARK AÐ RÁÐHERRA FARI MEÐ RÉTT MÁL ÞEG...

- REGLUR UM KLÆÐABURÐ Á VINNUSTAÐ - MENN EIGA BARA AÐ FARA EFTI...

- ERU "YFIRSKESSURNAR" Á ÍSLANDI KOMNAR Í "KASTLJÓSIÐ" HJÁ BAND...

- HÚN ÞARF NÚ AÐ FARA AÐ ENDURSKOÐA "FORGANGSRÖÐUNINA" HJÁ SÉR....

- ÖRLÖG HVALSINS ERU LÖNGU RÁÐIN...........

- HVAÐA "LYGI" KEMUR NÆST FRÁ ÞESSU "SKATTAÓÐA" BAKBORÐSSLA...

Færsluflokkar

- Bloggar

- Bækur

- Dægurmál

- Enski boltinn

- Evrópumál

- Ferðalög

- Fjármál

- Fjölmiðlar

- Formúla 1

- Heilbrigðismál

- Heimspeki

- Íþróttir

- Kjaramál

- Kvikmyndir

- Lífstíll

- Löggæsla

- Mannréttindi

- Matur og drykkur

- Menning og listir

- Menntun og skóli

- Pepsi-deildin

- Samgöngur

- Sjónvarp

- Spaugilegt

- Spil og leikir

- Stjórnmál og samfélag

- Sveitarstjórnarkosningar

- Tónlist

- Trúmál

- Trúmál og siðferði

- Tölvur og tækni

- Umhverfismál

- Utanríkismál/alþjóðamál

- Vefurinn

- Viðskipti og fjármál

- Vinir og fjölskylda

- Vísindi og fræði

Eldri færslur

2025

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007

Heimsóknir

Flettingar

- Í dag (4.7.): 5

- Sl. sólarhring: 201

- Sl. viku: 1051

- Frá upphafi: 1894627

Annað

- Innlit í dag: 2

- Innlit sl. viku: 648

- Gestir í dag: 2

- IP-tölur í dag: 2

Uppfært á 3 mín. fresti.

Skýringar

Athugasemdir

Það eru algjörir hálfvitar sem sjá um þýðingar á fréttum hjá mogganum.

Þetta er erlenda fréttin.

-----------------------------------

BEIJING (AP) -- The International Monetary Fund warned the world's wealthiest nations Sunday to watch their surging levels of government debt, saying it could drag down the growth needed to ensure continued economic recovery.

The economic crisis is leaving "deep scars in fiscal balances, particularly in the advanced economies," John Lipsky, the IMF's No 2. official, told the China Development Forum in Beijing. He said that countries that have been going into debt to stimulate their economies should now prepare for belt-tightening steps next year.

"Policymakers should be making it clear to their citizens why a return to prudent policies is a necessary condition for sustained economic health," said Lipsky, who is the fund's deputy managing director, according to remarks prepared for the conference.

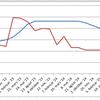

The IMF projects that gross general government debt in the G-7 advanced economies, except Germany and Canada, will rise from an average of about 75 percent of GDP at the end of 2007 to about 110 percent of GDP at end of 2014, Lipsky said.

This year, the average debt-to-GDP ratio in the wealthiest countries is projected to reach levels that prevailed in 1950 in the aftermath of World War II, Lipsky said. The ballooning of government debt also comes amid rising health and pension spending, he said.

"Addressing this fiscal challenge is a key near-term priority, as concerns about fiscal sustainability could undermine confidence in the economic recovery," Lipsky said, adding that in the medium term, large public debt could lead to higher interest rates and slower growth.

Countries should aggressively pursue reforms that will boost growth, such as the liberalization of goods and labor markets and the elimination of tax distortions, he said, though such moves on their own will be insufficient without direct measures to reduce spending.

They should also strengthen fiscal institutions in ways that could include improving tax collection and reinforcing fiscal responsibility legislation, while pursuing entitlement reforms, such as increasing the retirement age, to help in restoring finances, he said.

For the United States, Lipsky said a higher public savings rate will be required to ensure long-term fiscal sustainability.

"An increase in public saving would augment an expected rise in household saving to boost national saving and reduce the current account deficit," he said.

America's national debt -- now $12.5 trillion -- has been growing by leaps and bounds over the past decade, to the point where it threatens to swamp overall economic output. Roughly half of it is owned by global investors, with China holding the largest stake.

Japan's debt is proportionately even bigger -- about twice its GDP -- but the impact is cushioned by the fact that most is held by Japanese households.

In Europe and Japan, where there is already a high tax burden on labor, Lipsky said measures should focus on improving the targeting of social benefits and on reducing exemptions on indirect taxes.

Baldur Fjölnisson, 22.3.2010 kl. 11:00

Síðan má sjá hér hlutfall erlendra skulda af GDP og erlendar skuldir per einstakling í helstu komandi þrotabúum heimsins.

http://www.cnbc.com/id/30308959?slide=1

----------------------------------------------------

1. Ireland - 1,267%

External debt (as % of GDP): 1,267%

External debt per capita: $567,805

Gross external debt: $2.386 trillion (2009 Q2)

2008 GDP (est): $188.4 billion

2. Switzerland - 422.7%

External debt (as % of GDP): 422.7%

External debt per capita: $176,045

Gross external debt: $1.338 trillion (2009 Q2)

2008 GDP (est): $316.7 billion

3. United Kingdom - 408.3%

External debt (as % of GDP): 408.3%

External debt per capita: $148,702

Gross external debt: $9.087 trillion (2009 Q2)

2008 GDP (est): $2.226 trillion

4. Netherlands - 365%

External debt (as % of GDP): 365%

External debt per capita: $146,703

Gross external debt: $2.452 trillion (2009 Q2)

2008 GDP (est): $672 billion

5. Belgium - 320.2%

External debt (as % of GDP): 320.2%

External debt per capita: $119,681

Gross external debt: $1.246 trillion (2009 Q1)

2008 GDP (est): $389 billion

6. Denmark - 298%

External debt (as % of GDP): 298.3%

External debt per capita: $110,422

Gross external debt: $607.38 billion (2009 Q2)

2008 GDP (est): $203.6 billion

7. Austria - 252.6%

External debt (as % of GDP): 252.6%

External debt per capita: $101,387

Gross external debt: $832.42 billion (2009 Q2)

2008 GDP (est): $329.5 billion

8. France - 236%

External debt (as % of GDP): 236%

External debt per capita: $78,387

Gross external debt: $5.021 trillion (2009 Q2)

2008 GDP (est): $2.128 trillion

9. Portugal - 214.4%

External debt (as % of GDP): 214.4%

External debt per capita: $47,348

Gross external debt: $507 billion (2009 Q2)

2008 GDP (est): $236.5 billion

10. Hong Kong - 205.8%

External debt (as % of GDP): 205.8%

External debt per capita: $89,457

Gross external debt: $631.13 billion (2009 Q2)

2008 GDP (est): $306.6 billion

11. Norway - 199%

External debt (as % of GDP): 199%

External debt per capita: $117,604

Gross external debt: $548.1 billion (2009 Q2)

2008 GDP (est): $275.4 billion

12. Sweden - 194.3%

External debt (as % of GDP): 194.3%

External debt per capita: $73,854

Gross external debt: $669.1 billion (2009 Q2)

2008 GDP (est): $344.3 billion

13. Finland - 188.5%

External debt (as % of GDP): 188.5%

External debt per capita: $69,491

Gross external debt: $364.85 billion (2009 Q2)

2008 GDP (est): $193.5 billion

14. Germany - 178.5%

External debt (as % of GDP): 178.5%

External debt per capita: $63,263

Gross external debt: $5.208 trillion (2009 Q2)

2008 GDP (est): $2.918 trillion

15. Spain - 171%

External debt (as % of GDP): 171.7%

External debt per capita: $59,457

Gross external debt: $2.409 trillion (2009 Q2)

2008 GDP (est): $1.403 trillion

16. Greece - 161.%

External debt (as % of GDP): 161.1%

External debt per capita: $51,483

Gross external debt: $552.8 billion (2009 Q2)

2008 GDP (est): $343 billion

17. Italy - 126.7%

External debt (as % of GDP): 126.7%

External debt per capita: $39,741

Gross external debt: $2.310 trillion (2009 Q1)

2008 GDP (est): $ 1.823 trillion

18. Australia - 111.3%

External debt (as % of GDP): 111.3%

External debt per capita: $41,916

Gross external debt: $891.26 billion (2009 Q2)

2008 GDP (est): $800.2 billion

19. Hungary - 105.7%

External debt (as % of GDP): 105.7%

External debt per capita: $20,990

Gross external debt: $207.92 billion (2009 Q1)

2008 GDP (est): $196.6 billion

20. United States - 94.3 %

External debt (as % of GDP): 94.3%

External debt per capita: $43,793

Gross external debt: $13.454 trillion (2009 Q2)

2008 GDP (est): $14.26 trillion

Baldur Fjölnisson, 22.3.2010 kl. 11:10

Bæta við athugasemd [Innskráning]

Ekki er lengur hægt að skrifa athugasemdir við færsluna, þar sem tímamörk á athugasemdir eru liðin.